child tax credit 2022 tax return

Child Tax Credit. This credit is not available for ones 2022 tax returns if your.

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022 Fox Business

Federal income tax return during the 2022 tax filing season.

. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

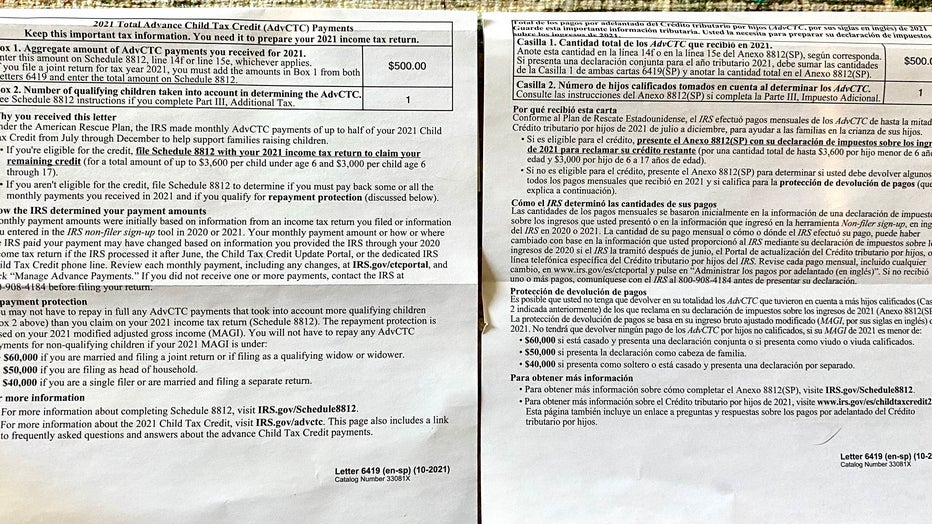

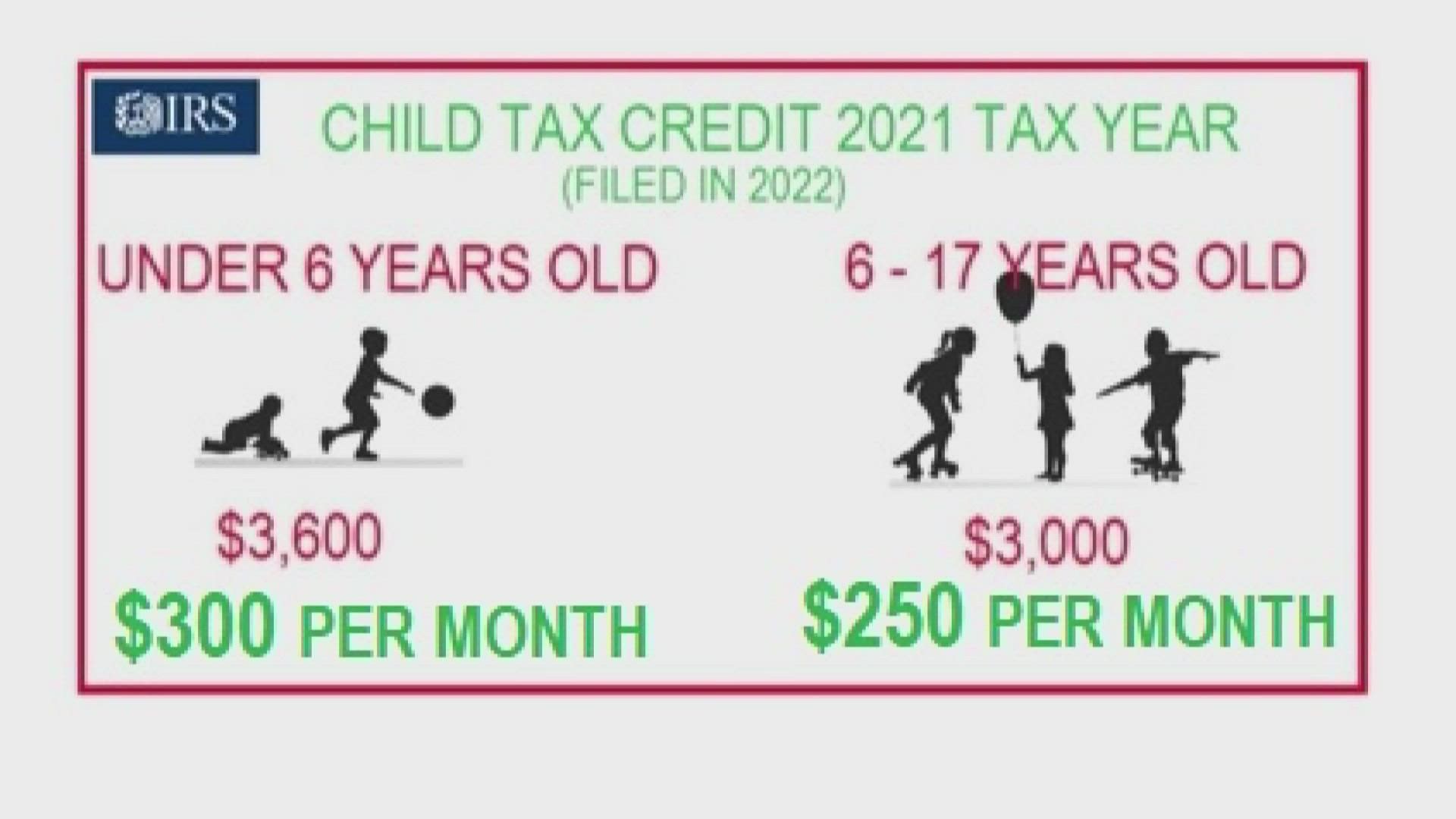

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return. Enhanced child tax credit.

Households that file a 2021 return could also be eligible for the expanded child tax credit and the earned-income tax credit. Up to 3600 per child or up to 1800 per child if you. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax. Individuals whose incomes are below 12500 and couples below 25000 may be able to file a. Instead residents will be able to receive the full amount of Child Tax Credit they are eligible for by filing a 2021 US.

Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments. The child tax credit can be claimed on your 2022 state tax return the Treasury Department said. Reverts back to up to 2000 for 2022 2025.

The Child Tax Credit Update Portal is no longer available. How much money you could be getting from child tax credit and stimulus payments. For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows.

Last year the IRS increased the potential payout of the Child Tax Credit to 3600 per child up from 2000 the year prior. The Child Tax Credit was expanded for one year in March 2021 by the American Rescue Plan. IRS Tax Tip 2022-33 March 2 2022.

The IRS said 2021 tax returns can also be filed at ChildTaxCreditgovfile. For your 2022 tax return the potential return per dependent aged. You can get half of your.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. To qualify for the credit the dependent must not file a joint return. The American Rescue Plan raised the earned-income.

The maximum child tax credit amount will decrease in 2022. You wont receive advance payments on the credit but instead you will get. The tax credits part of President Joe Bidens 19 trillion coronavirus relief program increased payments to up to 3600 annually for each child age 5 or younger and 3000 for.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. This tax credit helps offset the costs of raising kids and is worth up to 3600 for each child under 6 years old and 3000 for each child between 6 and 17 years old. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

Have been a US. The enhanced CTC during the pandemic was 3600 for children under 6 and 3000 for children 6 and up.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

May 17 Is Filing Deadline To Receive Child Tax Credit The Blade

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

It S A Unicorn Year For Mid Income Taxpayers Thanks To Pandemic Aid Politico

Tax Refund Schedule 2022 If You Claim Child Tax Credits The Us Sun

2021 Child Tax Credit How Will It Affect My 2022 Tax Return As Usa

Child Tax Credit 2022 How Irs Letter Could Help Earn More Money

Advance Child Tax Credit Filing Confusion Cleared Up

Child Tax Credit Payments Are Done How To Get Yours Wfmynews2 Com

What You Need To Know About Changes To The Child Tax Credit Jrj Income Tax Service

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

2022 Tax Refund How Child Tax Credit Affects Parents Across America Us Patch

2022 Irs Tax Advice What You Need To Know About Child Credit And Stimulus Checks Kob Com

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Everything You Need To Know About The Solar Tax Credit

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022