food tax in massachusetts calculator

65 100 0065. This page describes the taxability of.

How To Calculate Cannabis Taxes At Your Dispensary

List price is 90 and tax percentage is 65.

. There should not be any additional sales tax on any local level. Above the online tax refund calculator select yes on the left for full-year resident or no on the right for part-year resident. The tax is 625 of the.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. The Federal or IRS Taxes Are Listed. The price of the coffee maker is 70 and your state sales tax is 65.

The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. State Auditor Suzanne Bump announced Thursday that she had. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Multiply price by decimal. 15-20 depending on the distance total price etc. The meals tax rate is 625.

Maximum Possible Sales Tax. The base level state sales tax rate in the state of Massachusetts is 625. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules.

Estimate Your Federal and Massachusetts Taxes. Massachusetts State Sales Tax. Youll only need Form 1.

Food tax in massachusetts calculator Friday February 18 2022 Edit. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. 625 of the sales price of the meal.

Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers. In some states items like alcohol and prepared food. Maximum Local Sales Tax.

The most populous county in Massachusetts. These businesses include restaurants cafes. Companies or individuals who wish to make a qualifying.

Divide tax percentage by 100. After a few seconds you will be provided with a full. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates.

Massachusetts Income Tax Calculator 2021. The Massachusetts income tax rate. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Your average tax rate is 1198 and your. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. This income tax calculator can help estimate your average.

Average Local State Sales Tax. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

How To Calculate Sales Tax And Avoid Audits Article

Snap Calculator Could You Be Eligible For Help To Buy Food

Abcd Offers Free Tax Prep To Eligible Residents Abcd Action For Boston Community Development

How To Charge Your Customers The Correct Sales Tax Rates

Should You Move To A State With No Income Tax Forbes Advisor

The 5 States With No Sales Tax The Motley Fool

State Sales Tax Rates 2022 Avalara

Fineman Cpa Group Accounting And Tax Specialists In Canton Ma Serving The Growing Business And Entrepreneur

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Is Food Taxable In Massachusetts Taxjar

Marijuana Tax Rates A State By State Guide Leafly

Vermont Income Tax Calculator Smartasset

Paycheck Tax Withholding Calculator For W 4 Tax Planning

17 States With Estate Taxes Or Inheritance Taxes

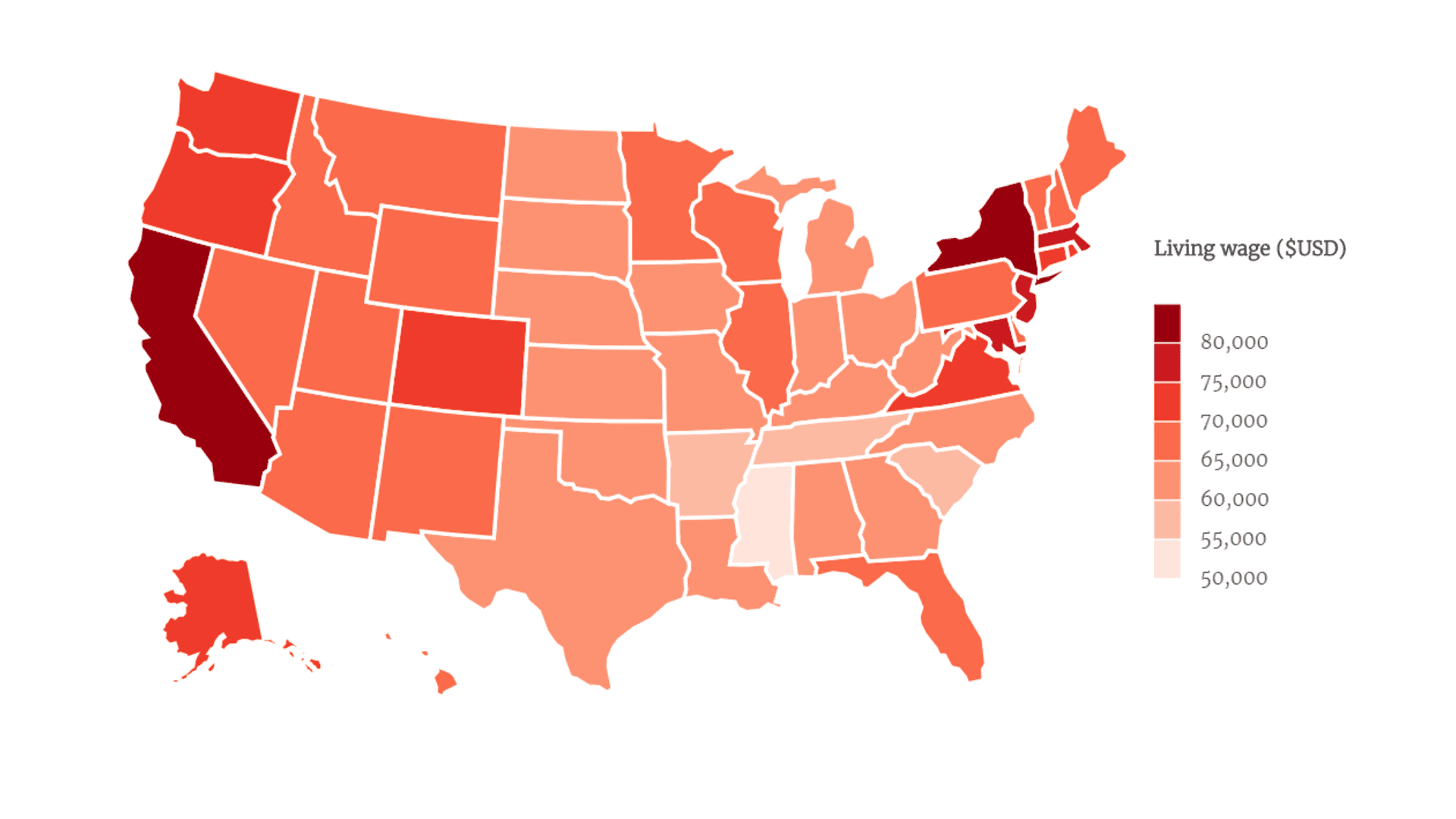

How Much Money A Family Of 4 Needs To Get By In Every Us State